IC Markets Review – Scam or Legit Forex Broker 2023

IC Markets Review – Scam or Legit Forex Broker 2023

| Min. Deposit200$ | Demo Account Yes, FREE! |

- Rating

- Maximum Leverage: 500:1

- Regulated By: ASIC, CySec, FSA

- Instruments: CFD, Forex, Crypto, Futures

- Trading platforms: MT4, MT5, cTrader

- Mobile App Trading: YES (iOS, Android and Windows)

Among the trusted forex market, icmarkets is probably the most selected forex market of the forex community in the world. Most traders give positive reviews about icmarkets.

Is IC Markets a Good Forex Broker? Read Real Reviews now: If you are looking for a trusted forex broker managed by the world’s leading financial institution, with fast execution and low spread, icmarkets will be a good choice for you. Let’s learn about forexfanclub: Are Ic markets really trusted and good for you to choose forex trading?

Contents

- 1 What are ic markets?

- 2 Review IC markets Broker

- 3 Conclusion: Ic markets reviews

What are ic markets?

IC Markets are a Forex Broker founded in 2007 and headquartered in Australia. ICMarkets has now become the largest forex broker in Australia. Largest in the world (In 2019, ICMarkets set a record of $ 646 billion in trading volume in March).

Ic markets is known as the true ECN forex broker with extremely low spread and commission.

Review IC markets Broker

Is trading at ic markets safe?

This is what most investors are interested in because many forex brokers scams have sprouted out and taken away investors’ money, so are ICmarkets safe to invest?

It is no coincidence that IC Markets is trusted by a large number of traders around the world. In addition to service quality, ICMarkets also brings peace of mind about legal provisions and insurance policies for its customers. Below are the legal information, operating certificates and insurance for investors at ic markets.

Certificates and operating licenses of icmarkets

IC Markets’s parent company is International Capital Markets Pty Ltd, headquartered in Sydney, Australia. Below are the licenses and operating certificates that icmarkets comply with.

IC Markets is authorized and regulated by the Australian Securities and Investments Commission (ASIC), which is one of the agencies that ensures fairness and transparency for financial markets in Australia.

Icmarkets is a member of the Australian Financial Complaints Agency (AFCA), an agency specializing in resolving disputes between consumers and service providers.

Ic markets are also registered and regulated by the Seychelles Financial Services Authority (FSA).

Insurance for investors at Icmarkets

IC Markets are managed by ASIC so you can be assured that your deposits are always safe as a separate account (Segregated account). At the same time, it is used as a basis to compensate customers in case the company goes bankrupt.

ICMarkets also has a professional insurance agreement with London-based Lloyds Insurance to protect investors.

Types of accounts and trading fees at icmarkets

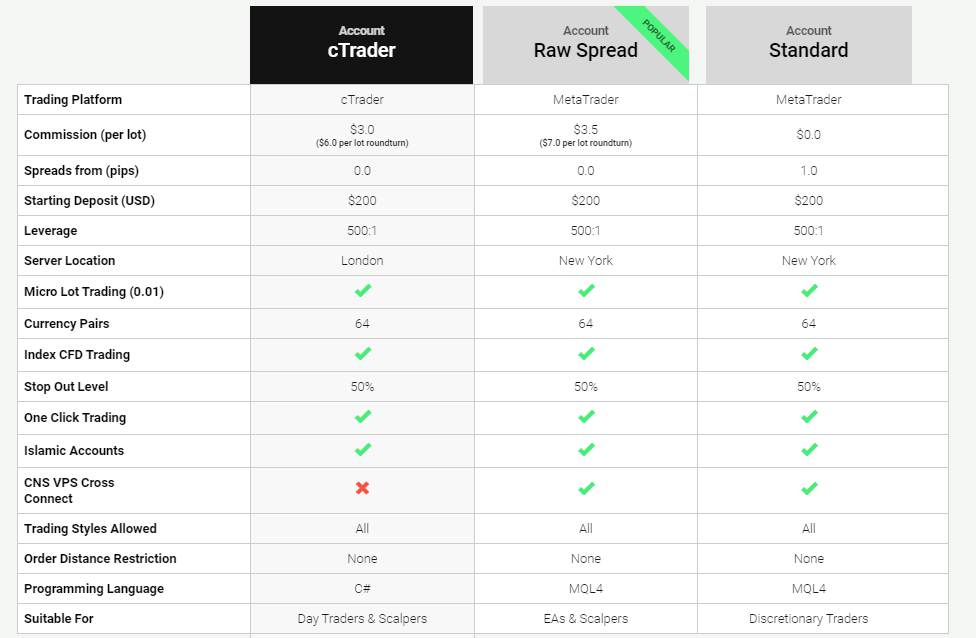

IC Markets have 3 main types of accounts: Standard Account, Raw Spread Account (MT4, MT5) and Raw Spread Account (ctrader) (note: Raw Spread Account formerly known as True ECN). Besides, ICMarkets also provides Islamic accounts – for Muslims.

Each type of account has its advantages and disadvantages, depending on the style and trading strategy of each person that chooses the account accordingly. Below are 3 main types of account information for you to choose an appropriate ic markets account.

1. The standard account provided by ICMarkets

Standard accounts only have spread fees, no commission fees, and spread at ic markets is quite low compared to other forex brokers (Spread from 1.0 Pip), this is the point that many traders choose.

2. Raw Spread Account (MT4, Mt5)

This type of account is highly appreciated and selected by many traders. Its advantages are low spread only 0.1 pips for EUR / USD and commission fee is quite competitive, fixed 7 USD/lot.

IC Markets Raw Spread account has fast execution speed, almost no delay. So this type of account is suitable for traders who like to trade Scalping or Day traders, even swing traders with average order holding time of several days are perfectly suitable.

The disadvantage of this type of account is that spreads can stretch quite strongly when there is strong news or at the time of opening/closing sessions.

3. Raw Spread Account (cTrader)

ICMarkets Raw Spread cTrader account has low spread and commission, suitable for Day traders and those who like to trade Scalping. However, due to their habit and many support tools (indicator, EA ..), most traders still trade mainly on MT4 platform and some on Mt5.

ic markets Trading platform

ICMarkets offer a full range of the most popular forex trading platforms available today (including MetaTrader 4 – MT4, MetaTrader 5 – MT5 and cTrader). All platforms are available for Windows, Mac as well as on mobile (Android and iOS operating systems) for user convenience.

However, MT4 is still the most popular trading platform and is considered to be the most friendly to traders, so most brokers offer this platform and ICMarket is no exception. MT4 provides all the tools that a forex trader needs: technical indicators, advanced charting packages and EA.

Review deposit and withdraw money at IC market

Deposit and withdrawal methods at IC market

Ic markets offers a variety of popular deposit and withdrawal methods that make it easy for traders to conduct their financial tradings: Online transfer, Visa / Master card, via international electronic wallets. (Neteller, Skrill, Paypal).

Frequently questions when Deposit and withdrawal at Icmarkets:

- How long is the deposit time?

Most of your deposit will be added to your account almost immediately. - What is the minimum amount needed to open a trading account?

IC Markets allows clients to open an account with as little as USD $200 or currency equivalent. - Deposit and withdrawal fees at Ic markets?

Ic market does not charge for your deposit and withdrawal, however, a third party (bank, e-wallet) may charge you to convert your foreign currency at a separate rate. If you deposit and withdraw money from Neteller, Skill wallet, you will not be charged. - How long does it take to receive a withdrawal?

Typically, if a withdrawal request is received before 01:00 GMT (12:00 AEST) it will be processed on the day of receipt. If your withdrawal request is received after this time, it will be processed on the following business day. (Usually no more than 3 business days).

Customer support review

Customer support at Icmarkets is quite good, you can contact customer service at Live chat, via email or phone. IC Markets supports up to 18 different languages in the world. Support time is usually less than 15 minutes.

Here are the contact details for IC Markets:

- Email: support@icmarkets.com

- Global Phone Numbers: +61 028 014 4280

- Live Chat 24/7

Conclusion: Ic markets reviews

Advantages:

Icmarkets is overseen by the world’s most trusted financial management agencies, low in phosphate, with low Spread, Competitive commission fee (suitable for Scalping traders), fast and enthusiastic support staff. Various deposit and withdrawal options to choose from.

Defect:

The disadvantages of ic markets are that the withdrawal time is considered to be quite long compared to other forex brokers and the minimum deposit (from $ 200). However if you want to invest in forex, this probably is not a large amount of money right? And you can completely experience Icmarkets Demo account completely free.

Please Note: IC Markets does not accept applications from residents of the U.S, Canada, Israel and Islamic Republic of Iran.

Risk Warning: Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary.

If you have any questions or you have experienced real trading at icmarkets, please leave a comment to share with eone your opinion or opinion about the fraudulent icmarkets? Is it trusted? Should I also trade at ic markets?We look forward to sharing from you!